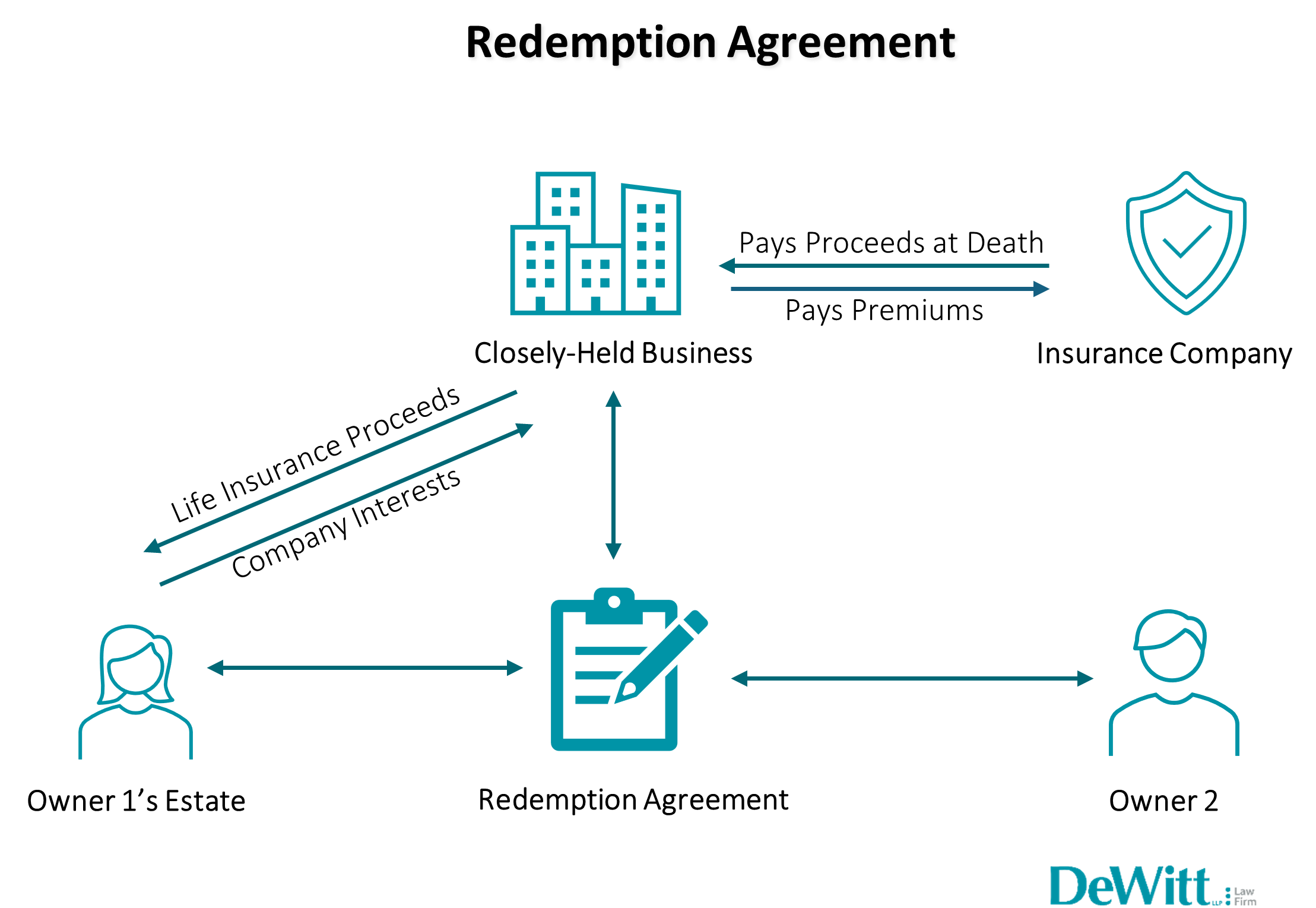

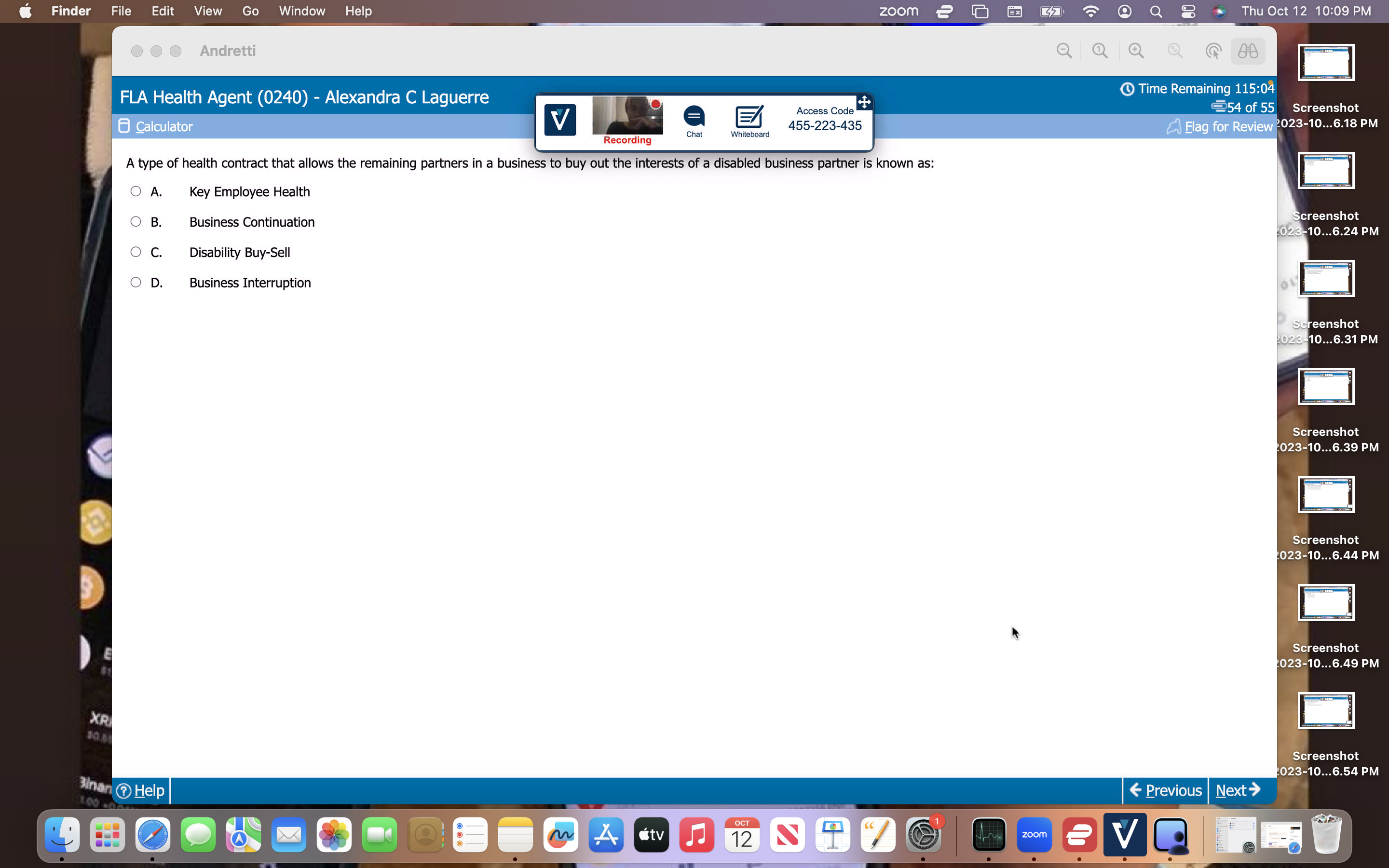

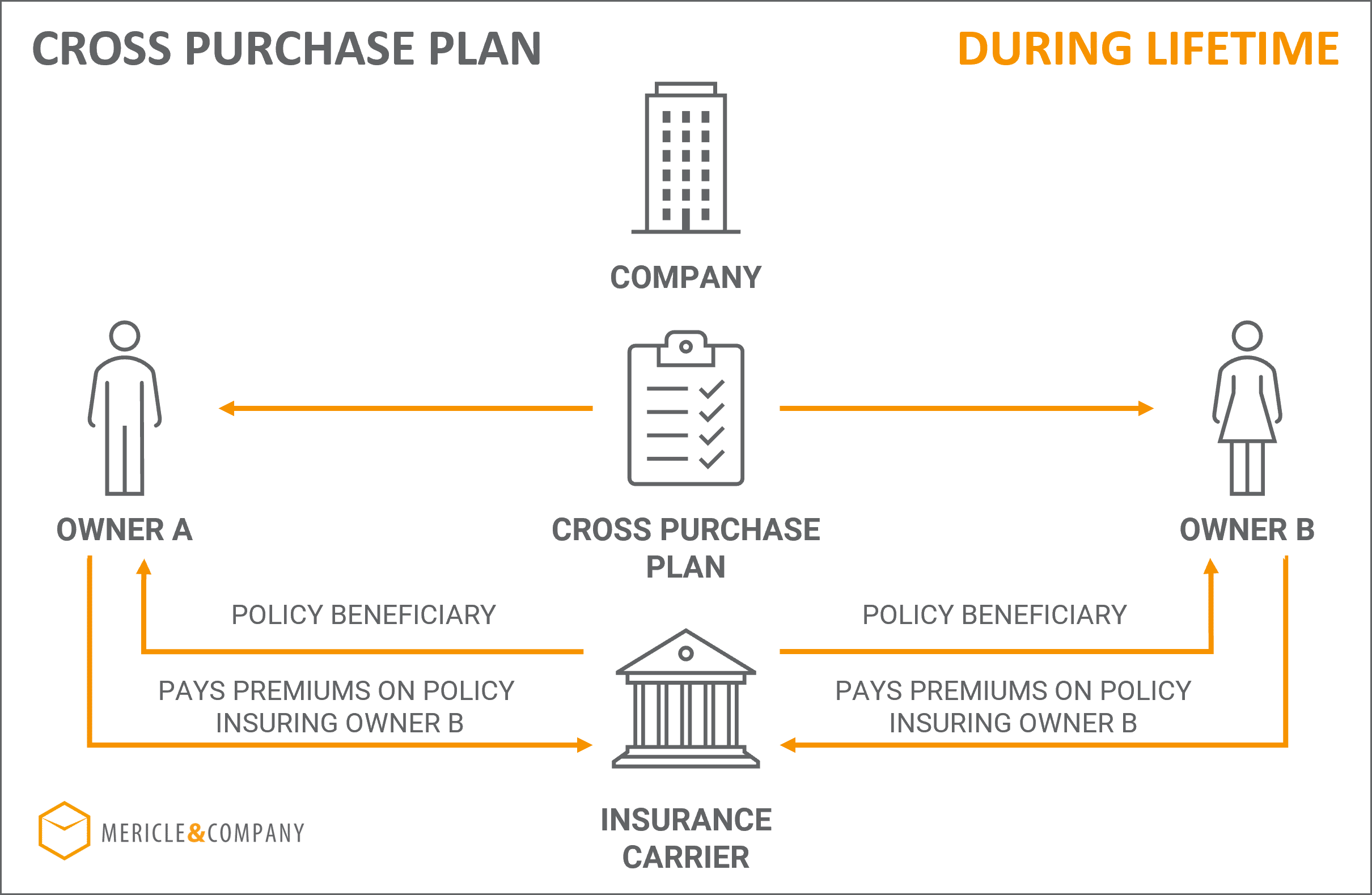

If the owner dies or becomes disabled, the policy would provide which of the. A policy owner would like to change the. With life insurance, the needs. Split dollar plan b. Benefits are taxable to the business entity b. Here’s the best way to solve it. Powered by chegg ai. View the full answer. A) the length of time a disability must last before the remaining partners can buy out the. Which of the following disability buy sell agreement is best suited for businesses with a limited number of partners. To ensure an orderly transfer of your business when you die; To set a value on the business for transfer and.

Related Posts

Recent Post

- Tiktok Oa Questions

- Usp Victorville News 2023

- Gangsta Disciple Gang Signs

- Ronald Lee Hunsecker Obituary Oklahoma

- Spectrum Sales Agent 722

- Factory Jobs Hiring Near Me

- Starting Pay At Hardees

- My Metro Pay Online

- Warren Ohio Tribune Obituaries

- Cvs Benefits Employee

- Simple Living Alaska Gossip

- Trapshooters Com Forum

- Skip The Games Tulsa

- Brazos County Busted Newspaper Today

- Shabbat Candle Lighting New York

Trending Keywords

Recent Search

- Armslist Sc

- Q18 Bus Route

- Zillow Homes For Sale Cleveland

- Reddit True Crime

- Truth Of God

- Chief Joseph Highway Road Conditions

- Ithaca Journal Obituaries Ithaca Ny

- Oregon Coast Aquarium Tickets Price With Ebt Card

- Skip The Game Boston

- Ranking Of Sororities At Alabama

- Valley News Dispatch Obituary

- Patch Lansdale

- Craigslist Jobs Fort Pierce

- Imdb Born September 1992 Imdb

- Fidelity Credit Card Reconsider

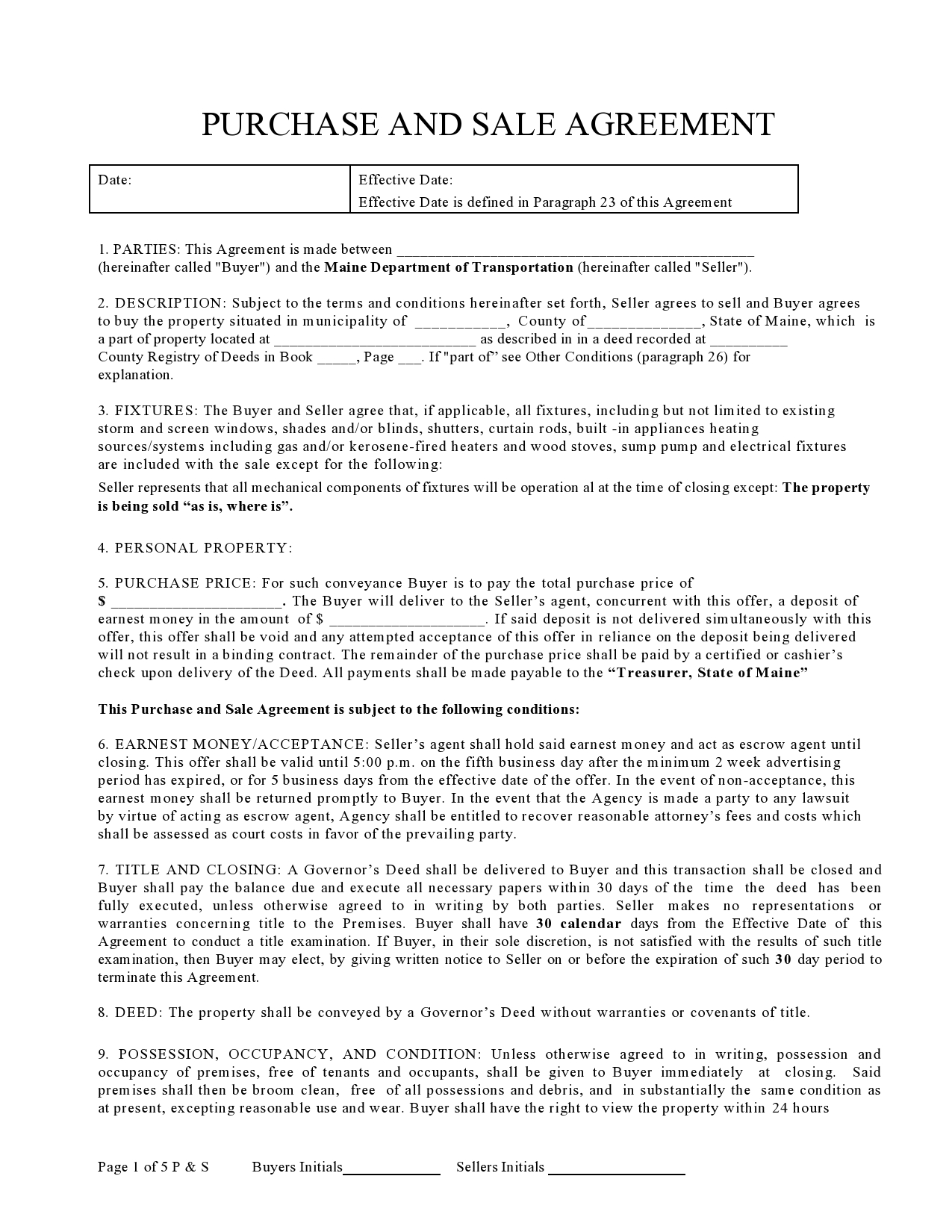

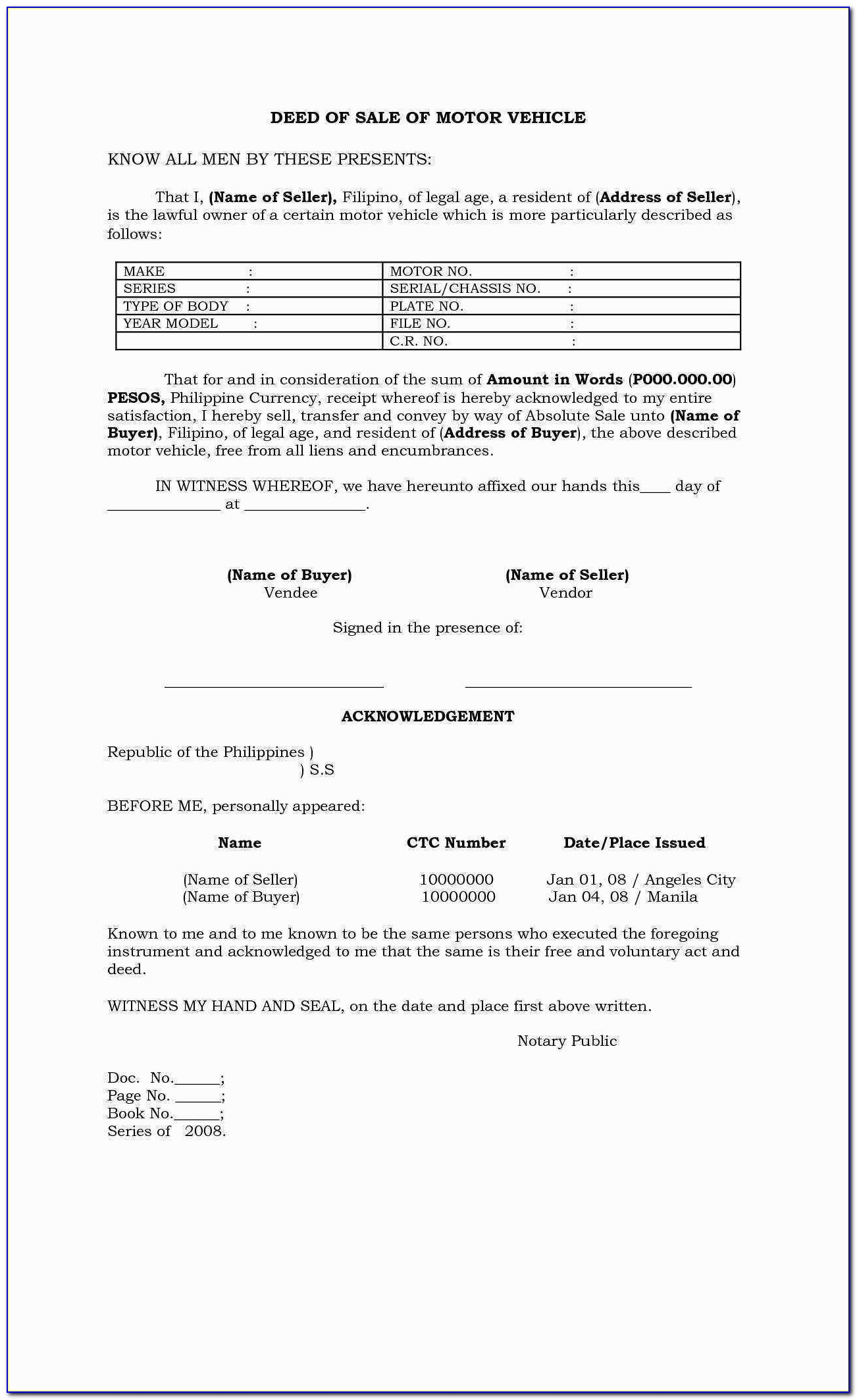

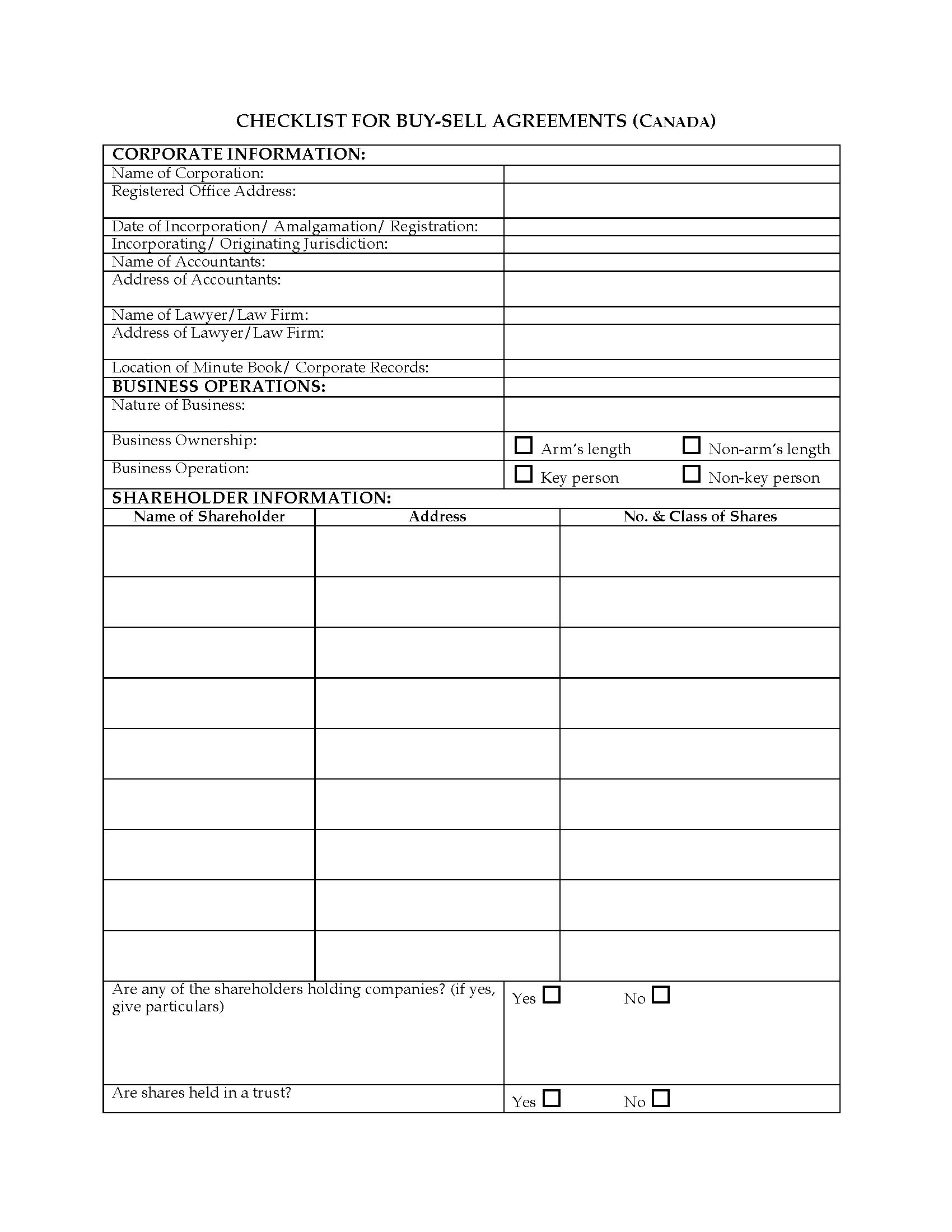

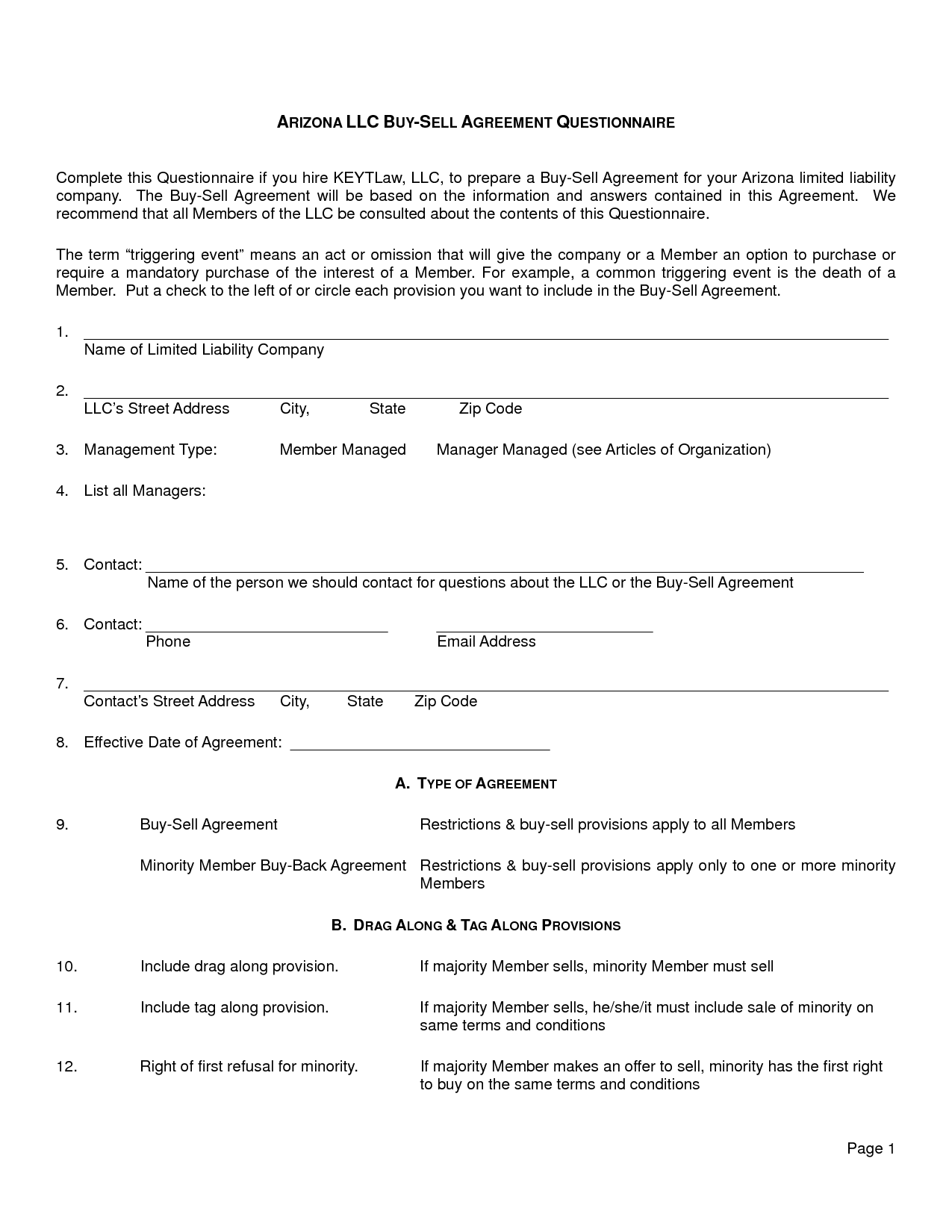

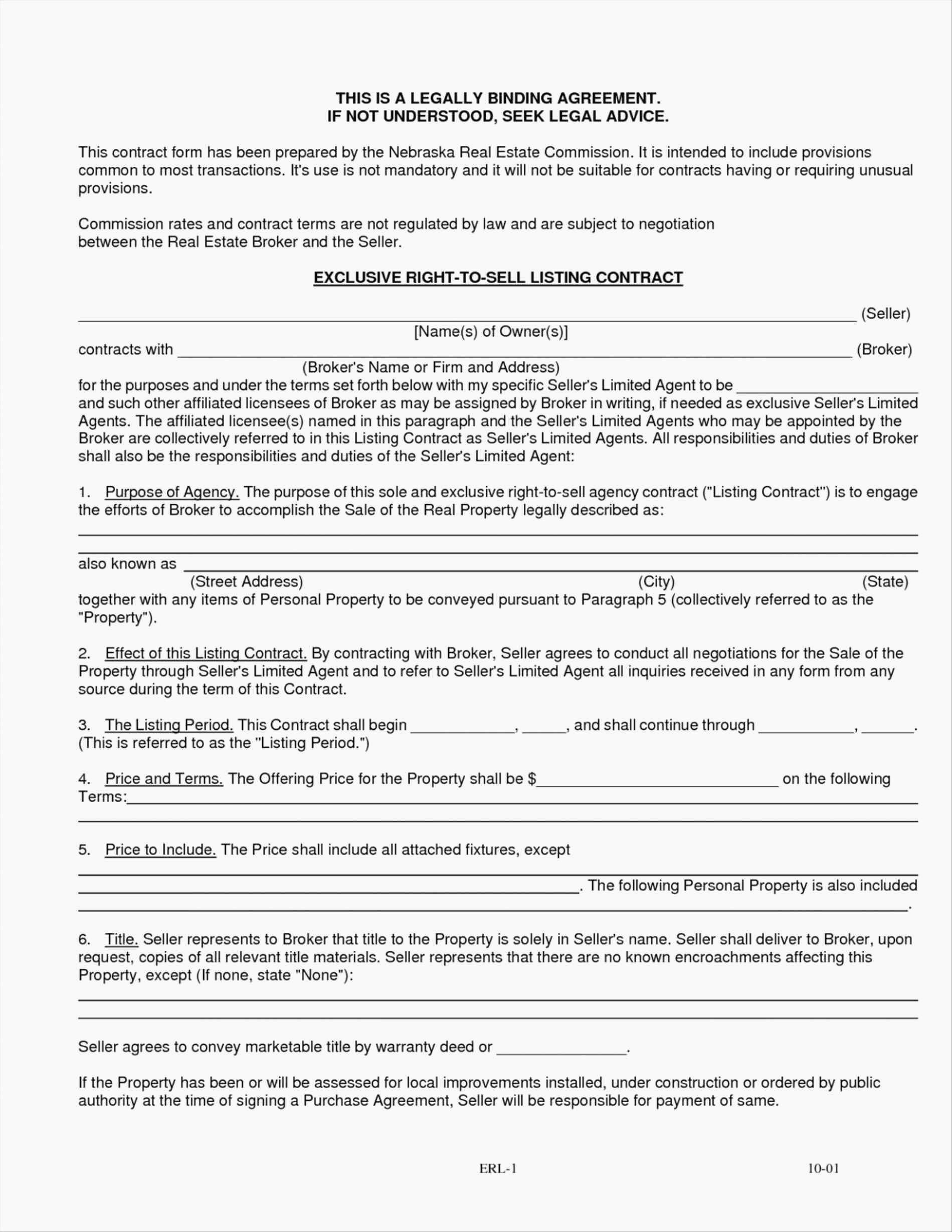

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-PDF-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Word-Document.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Template-of-Buy-Sell-Agreement-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Blank-Form-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Formatted-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Document-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Example.jpg)